Proposed budget highlights include:

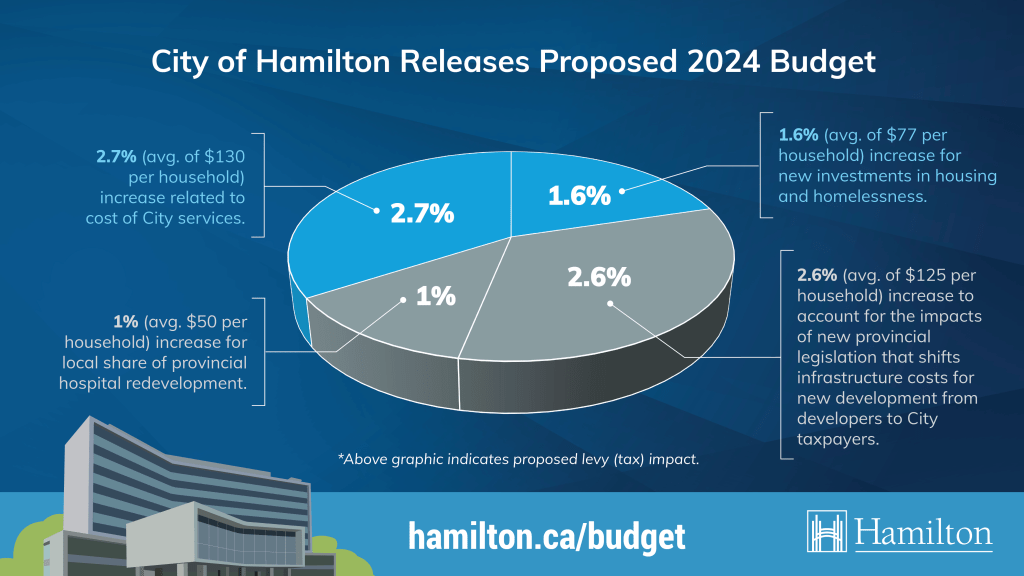

- The proposed Budget includes a 4.3 per cent residential property tax increase ($207 per household) to maintain existing City services and provide for $19.2 million in important new investments in housing and homelessness initiatives.

- The proposed Budget also includes a 2.6 per cent tax increase ($125 per household) to cover the impacts of new provincial legislation that shifts infrastructure costs for new development from developers to City taxpayers.

- In addition, the proposed Budget reflects a 1.0 per cent tax increase ($50 per household) to accommodate a municipal investment in provincial hospital redevelopment.

- Overall, the 2024 proposed Budget represents an average residential property tax increase of 7.9 per cent.

In September, City Council was presented with a Budget Outlook that predicted a 14.2 per cent property tax increase, including the costs of covering provincially mandated impacts. The proposed 2024 Budget was created following Mayor Horwath’s direction to City staff to present a combined operating and capital budget that reduced the burden on taxpayers by responsibly using strategic reserves, screening budget submissions for redundancies and efficiencies, and prioritizing new spending against its ability to advance council identified priorities.

Round 2 of Public Engagement

The public will have an opportunity to delegate to Council on the proposed Budget on January 16, 2024.

Following the public delegations, the next steps for the budget process are as follows:

- January 19, 2024 – General Issues Committee Budget Overview; presentations from external economist and staff on the City of Hamilton’s Economic Outlook and Budget Overview

- January 22 to January 26, 2024 – General Issues Committee presentations from City Departments and from Boards and Agencies

- January 30, 2024 – General Issues Committee Budget Deliberations

- February 15, 2024 – Special Council Meeting to consider final budget approval

I have not had the opportunity to fully review this budget. But, I remain concerned about the overall increase in the 2024 operating expenditures. I appreciate the creative use of city reserves and debt to lower the tax increase on residential taxes to 7.9%. I am equally aware that any budget increases funded from city reserves does not lower the actual 2024 operating expenditures, it simply defers the hit to Hamilton taxpayers until 2025 or beyond. For example, using the original 14.2% projected increase in operating expenditures as an example, 7.9% would be funded from taxpayers and the remaining 6.3% would be funded from reserves. Next budget cycle, the City will start the budget process with a 6.3% increase to the taxpayers from 2024 increase in spending as well as any new spending in 2025. Using reserves to fund annualized operating expenses is simply borrowing from the city’s reserves (savings account) to defer 2024’s property tax increases to 2025 or beyond. I cannot support this strategy and I look forward to participating in Council’s budget deliberations.